Quantum Computing – The Blockchain Killer?

The Emerging Threat to Blockchain Technology and How to Fight It.

The launch of Bitcoin futures over the weekend has spurred new rounds of discussions about what currently threatens the cryptocurrency giant. Now that Bitcoin has a direct link to the traditional financial world, regulators will be chomping at the bit to impose their will on it. The CFTC is already involved by proxy, as they regulate the exchanges that Bitcoin futures trade on. Though the SEC is not involved directly with Bitcoin yet, they’ve recently made their mark on cryptocurrencies in general.

Part of the reason why the cryptocurrency community takes regulation so seriously is that cryptocurrency security is the lynchpin of longevity, and therefore the key to success. If regulators and central governments were able to compromise cryptocurrency security via regulation or other means, long-term viability would collapse.

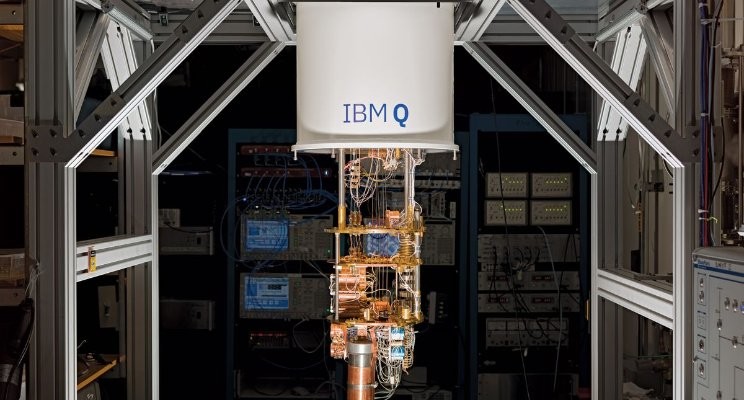

That being said, cryptocurrency proponents should also be aware of security threats from other entities--ones that are in a similar stage of development. Like cryptocurrencies and blockchain technology, the field of quantum computing is coming of age.

Quantum computing makes use of quantum-mechanical components to analyze data. Quantum computers use quantum bits (qubits) instead of binary digits (bits) to store information. So, whereas classic computer data points have a state of either zero or one, qubits have a “superposition” of states, that is, multiple values at the same time. The result is that quantum computers can store an incredible amount of data and use less energy than traditional computers. Some quantum processors are over 100 million times faster than their current counterparts.

What does this have anything to do with blockchain technology and cryptocurrencies? Cryptocurrencies like Bitcoin operate on using public key cryptography. This means that the systems use pairs of keys to conceal data. The public key is known to everyone on the blockchain, but the private key is known only to its owner.

The public key systems link the two keys together using complex mathematics. The link is equal to the factors of a number that is the product of two enormous prime numbers. Thus to extract a private key from the public key alone, a hacker would have to figure out the factors of the number--which itself is the product of the prime numbers. Because these numbers are so large, it would be impossible to crack the code in a lifetime, at least with a traditional computer.

If a hacker or group of hackers were to use a processor 100 million times more powerful than current processors, however, it would be entirely plausible to determine private keys only using public keys. In this case, a blockchain which shares only public keys is altogether exploitable.

This is where quantum computing steps in. If hackers got their hands on a quantum computer, they could theoretically hack cryptocurrency ledgers en masse and take control of entire blockchains. What was a giant leap for traditional computers is a small step for quantum machines?

Now, to be sure, this process would take around ten years, according to an interview done by MIT Technology Review. Because of the complexity of the encryption codes, the number of keys, and the evolution of blockchain technology, cryptocurrencies have bought themselves some time. What’s more, quantum computing is still young and has lots of internal kinks that need to be worked out. Nonetheless, the threat is indeed growing.

In the meantime, what can blockchain enthusiasts do to mitigate the risks of potential quantum attacks? The most direct solution is to create quantum resistant ledgers. One group is doing just that by generating private keys in a much more mathematically complicated way than prime factorization. Instead of top factorization, the protocol will generate private keys using hash-based cryptographic structures. In this case, it is computationally impossible to brute force a solution, something quantum computers could do with traditional blockchains.

Another option is to begin using private blockchains. Private blockchains, as their name suggests, are different from public blockchains in that access permissions are strictly controlled. Participants must be invited to join and need to be validated by the network creator or protocol the network creator has put in place. In this sense, private blockchains are essentially permission-driven blockchains.

This would prevent quantum computers from determining private keys from public keys since no public keys exist. The main detractor, however, is that private blockchains are not decentralized and distributed in the same way as public ones. Private chains can utilize tier structures, thereby creating the opportunity for factions and centralized authority. For many, this violates the philosophical underpinnings of cryptocurrencies and blockchain technology.

Thankfully, cryptocurrency teams and blockchain developers have time to develop and test-run solutions. With the creation of quantum resistant ledgers already in the pipeline, the threat of quantum computing may not be as dire as initially thought.

My thoughts on the Bitcoin blockchain vs. the Quantum threat? Because blockchain has been able to pass over ten years without any hacks, it looks like the basics are very well set. Through Quantum computing, Even if you hack 999.999 computers, if only one is still working with a copy of the blockchain (let’s assume it is an offline one), then you can retrieve everything from the start of the bitcoin, and copy/paste the information very quickly through the network. The inventor of bitcoin created two cryptographic systems for security. The first is elliptic curve manipulation, which is a one-way function that uses prime factorization mathematics. It is indeed vulnerable to quantum tech. The second method of encryption, however, uses hash algorithms, which we do not have algorithms for breaking yet, even in quantum computing. The elliptic curve is not public until it is claimed. The first time the key to this algorithm is available has already been used or processed. So if someone were to hack into it, there would be nothing there. It is mostly a key to nothing.

Also, don't forget that Quantum computing is a very complicated creature that has much demands…-460 Degrees Fahrenheit to be active for example…and the costs are not cheap. Currently, the price of a quantum computer is approximately US$10,000,000.

Every cryptographic algorithm ever invented has a shelf life between 20 and 30 years before becoming vulnerable to broadly available commercial technology that can crack it.

It’s a continuous arms race. The good news is that the bitcoin blockchain can always get an upgrade to its algorithm to resist the Quantum threat and implement quantum-resistant cryptography. Now since this risk is not an immediate threat (maybe in 10 to 15 years, this might be commercially useful), I cannot see any reason to worry.

Product Management | #People | #Leader | #Innovation | #Data Driven | #Results Oriented | #Agile |

6yFollowing